Federal Reserve Announcement vs. Market Movement

November 29, 2022

Federal Open Market Committee (FOMC) meets every month to decide whether to adjust the fed rate. We generally consider this fed rate as interest rate as it is the base rate of various lending rates offered in banks.

In a very simple way, the burrowing rate from bank should be at least larger than this fed rate. As of November 2022, the fed rate of around 1% corresponds to 5% of 5-year fix rate lending rate (mortgage rate).

The fed rate is a base rate that other factors such as loan term (duration of burrowing), credit score, collateral, market view on interest rate will affect how much the rate should be increased.

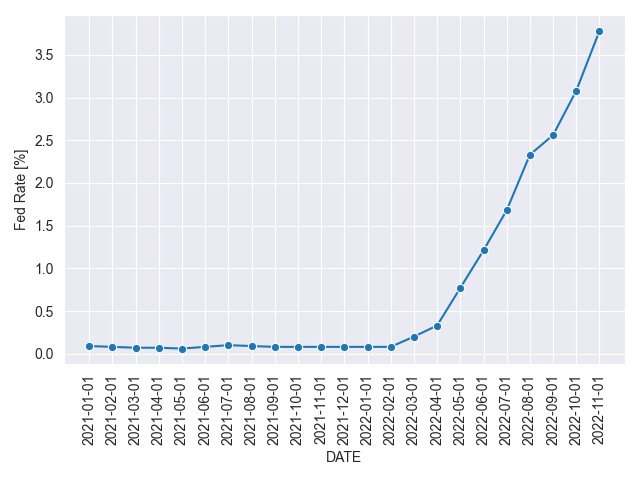

The figure below is the recent historical fed rate 1.

You can observe from the historical fed rate that it started to hike since March of 2022 when Federal Reserve focused on inflation. Before 2022, Fed rate remained very low (near zero) due to slow enconomic condition before pre-pandemmic and during pandemic.

When the interviewer asked about the first 25 basis point (0.25%) interest rate hike on March of 2022, Federal Reserve Chair Jerome Powell quoted as follows:

as we raise interest rates, that should gradually slow down demand for the interest-sensitive parts of the economy. And so what we would see is demand slowing down, but just enough so that it’s better matched with supply. And that brings—that will bring inflation down over time. That’s our plan.

Also, Powell mentioned that the unemployment is 3.8% in February (lowest since pre-pandemic) and labor market was stronger than expected.

We just discussed inflation with unemployment rate (one of labor market indexes). The monetary policy from Fed by increasing fed rate will have negative impact on business, because it is harder / expensive to burrow money.

As Economy slows down (i.e., people spend less and less), it would cause the living cost to go down as well. The by-product of this monetary policy is that there will increase the unemployment rate. However, Powell was expecting that the unemployment rate in March was still very low, so negative impact on slowing down the economy will be manageable.

It is important look closely on Powell’s expectation and the tone of his speech. The first rate increase in March sounded like it would just slow down the spending and lower inflation while remain strong economy.

Now, let’s move to the rate hike announce on June 15, 2022, when Fed raised 75 basis point (i.e., a giant step). During the announcement and interview, Powell mentioned that Fed policy on inflation is from ‘neutral’ to ‘restrictive’ and there will be more rate increase to come to lower the inflation. He also added that the resulting fed rate is around 1.25% which is still lower than normal condition not to be too worried about.

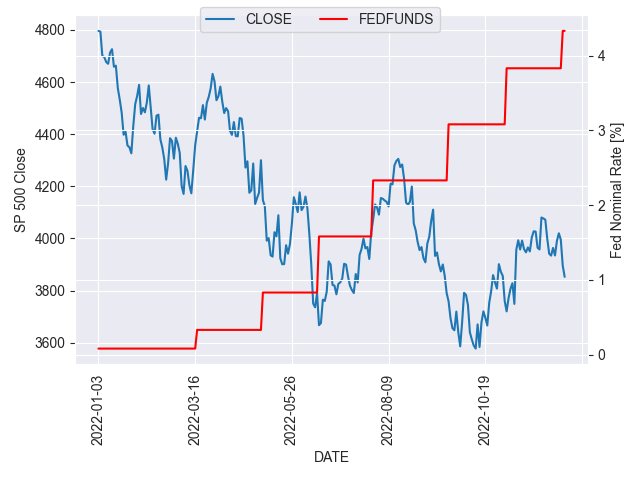

Here is the market overall reaction with the FOMC announcement 2. Market overall reaction is represented by Standard & Poor 500 (S&P500) index.

It is important to note that Fed rate increase on announcement date does not directly to relate to either downward or upward of market.

The start of fed rate hike triggered the overall market to go down.

Even there was the giant step (75 basis point) on 6/15/2022 FOMC meeting, the market did not go down any further. This can be considered as the market’s agreement on Federal Research decision and focus on the inflation.

Market agreed that Fed movement was to help the long term strategy to reduce inflation.

However, consecutive rate hikes and unresolved inflation metrics such as CPI index worried the overall market to trending the downward.

What I want to say is fed rate adjustment is one of many monetary policies based on many factors. Russia and Ukraine are still in war and there is energy crisis to make CPI to remain high. Even though labor market was strong, many IT companies started to lay-off or to freeze hiring in September onward. I would safely assume that there will be several big step (50 basis point) rate increases in 2023. If there is no unexpected happenings then I’m expecting the overall market will be stabilized later in 2023. The stable market would be the S&P500 market level of 4500 point that we hit in early 2022.

-

It is the effective federal funds rate (EFFR). The rate is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates ↩

-

To make the analysis simple, I used the nominal fed rate on the announcement dates. Therefore, it looks like stepwise function in the plot. ↩